The Ultimate Guide To How Does Medigap Works

Wiki Article

Top Guidelines Of How Does Medigap Works

Table of ContentsWhat Is Medigap Fundamentals ExplainedSome Known Details About How Does Medigap Works 3 Simple Techniques For What Is MedigapGetting The Medigap To WorkGetting My Medigap To Work

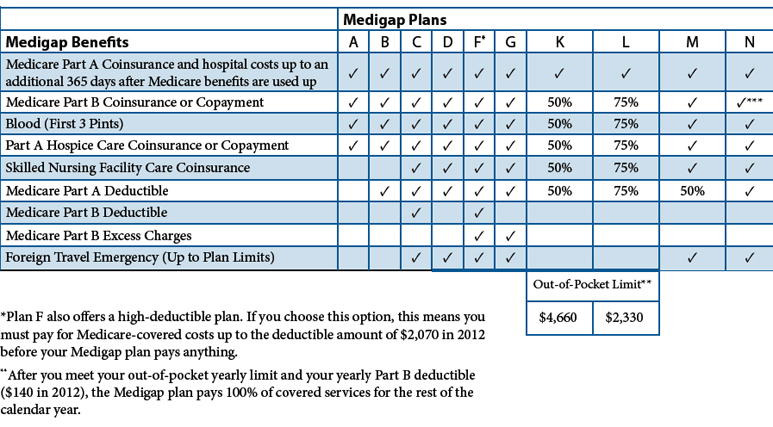

Medigap is Medicare Supplement Insurance policy that aids fill "voids" in Original Medicare as well as is offered by private companies. Original Medicare pays for much, but not all, of the expense for protected healthcare solutions as well as materials. A Medicare Supplement Insurance Policy (Medigap) plan can aid pay a few of the continuing to be healthcare costs, like: Copayments Coinsurance Deductibles Keep In Mind Note: Medigap intends offered to people brand-new to Medicare can no much longer cover the Component B deductible.If you were qualified for Medicare prior to January 1, 2020, but not yet enrolled, you might be able to buy one of these plans that cover the Component B deductible (Strategy C or F). If you currently have or were covered by Plan C or F (or the Strategy F high insurance deductible variation) prior to January 1, 2020, you can maintain your strategy.

A Medigap plan is different from a Medicare Benefit Plan. Those strategies are methods to obtain Medicare advantages, while a Medigap policy just supplements your Original Medicare advantages.

You pay this month-to-month costs in enhancement to the month-to-month Component B premium that you pay to Medicare. A Medigap plan only covers one individual. If you and your partner both want Medigap protection, you'll each have to purchase separate plans. You can buy a Medigap policy from any insurer that's licensed in your state to offer one.

The Definitive Guide for Medigap Benefits

A Medigap plan (also called a Medicare Supplement), offered by personal business, can aid pay a few of the healthcare costs Initial Medicare does not cover, like copayments, coinsurance and deductibles. Some Medigap strategies likewise use coverage for services that Original Medicare doesn't cover, like clinical treatment when you take a trip outside the U.S

Some actions you might wish to take include the following: Make certain you are qualified to purchase a Medigap. Bear in mind that you can only have a Medigap if you have Original Medicare. If you are enlisted in a Medicare Benefit Plan, Medigaps can not be marketed to you. There may be various other Medigap qualification requirements that apply to you, relying on the state in which you live.

8 Easy Facts About Medigap Benefits Described

Medigap is extra insurance coverage that assist cover the costs delegated a Medicare beneficiary What are Medigap strategies? Medigap vs. Medicare Benefit Costs Exactly how to enroll Frequently asked questions If you have just recently signed up in Medicare, you might have become aware of Medigap strategies and also questioned how they function. Medigap plans, likewise known as Medicare Supplement plans, help cover some out-of-pocket expenses related to Original Medicare.

When you sign up, your Medicare Advantage Strategy takes over the management of your Medicare Part An and Medicare Component B coverage. Medigaps are planned simply to cover the Medicare prices that Original Medicare delegates the continue reading this recipient. If you have a Medigap plan, Medicare pays its share of the Medicare-approved amount for protected services and after that your Medigap plan will pay its share of covered advantages.

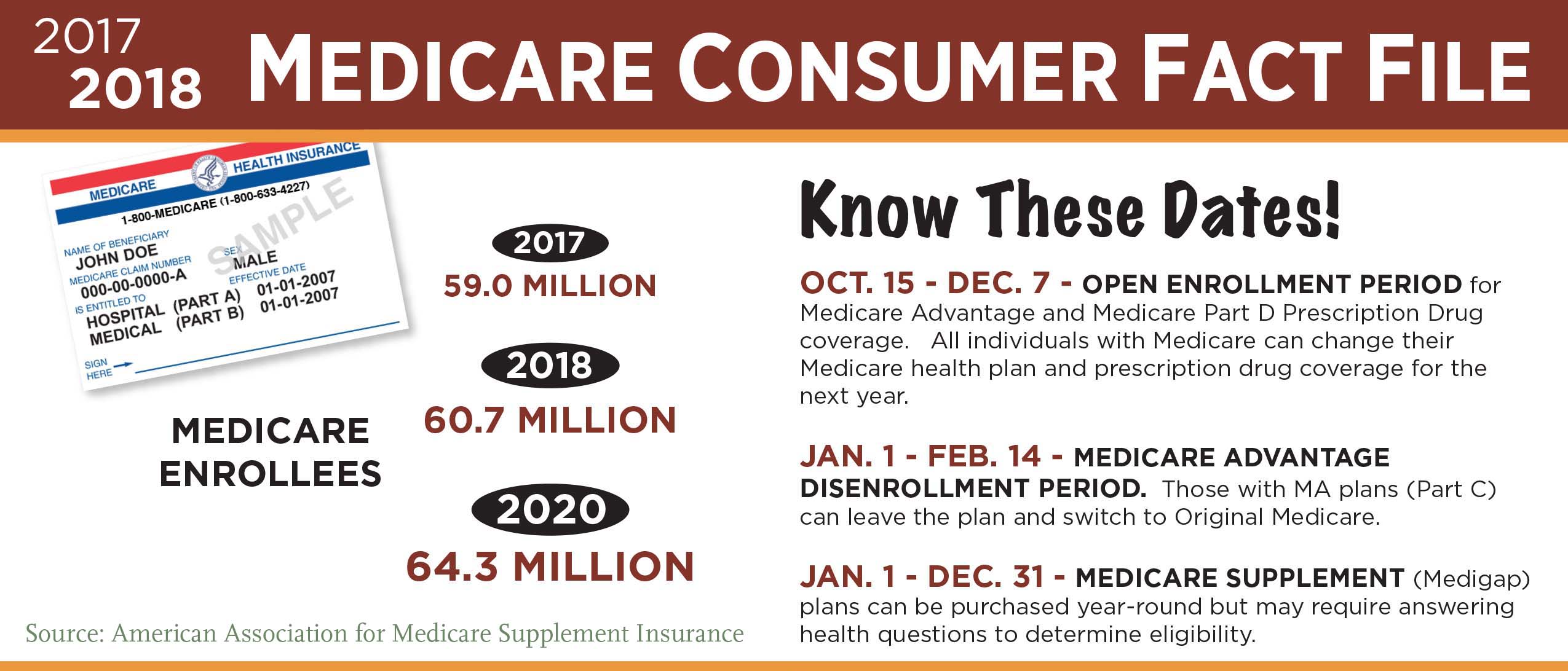

The month-to-month repayment will differ depending upon numerous elements. The most impactful are age, where you live, and also tobacco usage. In 2022 with Strategy F, you can anticipate to pay in between $160 and $300. Plan G would usually check my blog vary between $90 as well as $150, and also Strategy N would certainly be around $78 to $140.

The Ultimate Guide To How Does Medigap Works

Enlisting in a Medicare Supplement insurance coverage plan will certainly assist in covering expenditures. Step 1: Decide which advantages you want, after that make a decision which of the Medigap plan kinds (letter) meets your demands. Step 2: Figure out which insurance policy business market Medigap policies in your state. Step 3: Discover the insurer that offer the Medigap policies you have an interest in and contrast costs.The ideal time to obtain a Medicare Supplement plan is during your six-month Medigap Open Registration Duration. The Open Enrollment Period begins the initial month you have Component B coverage and you're 65 or older. Since Medigap strategies are supplied by private insurer, they are typically permitted to utilize clinical underwriting to decide whether or not to accept your application as well as what your expense will be.

The list below factors can impact the cost of Medicare Supplement prepares: Your place Your gender Your age Cigarette use House discounts Exactly how you pay When you enlist Medigap premiums should be authorized by the state's insurance policy division and also are established based upon strategy background as well as operating expense. There are 3 rankings made use of that can affect your rates and rate increases.

Issue Age does not indicate the plan will certainly not see a price increase. You will normally pay more when you're more youthful yet less as you age.

The Main Principles Of Medigap

Area Rated: Neighborhood ranking means everybody in the neighborhood pays the exact same rate. Most states and also service providers make use of the acquired age score when pricing their Medicare Supplement insurance.Report this wiki page